By Eve Samples

Palm Beach Post Staff Writer

Wednesday, June 14, 2006

ORLANDO — Beyond the imposing guardhouse and broad white gates at Lake Nona Golf & Country Club, moss-draped oaks lead the way to block after block of multimillion-dollar homes.

The posh and privileged setting, which earned a spot on Travel & Leisure's ranking of the country's top golf course communities this year, is the image linked most often to Lake Nona, the sister community to the Isleworth development where Tiger Woods has a home.

But outside those gates, a new Lake Nona is sprouting — one with fewer cul-de-sacs and more grassy squares. And that urban expansion could become the new home to the Burnham Institute for Medical Research, the sister institute to The Scripps Research Institute.

As a team of top Burnham officials visit Orlando this week, they will weigh whether Lake Nona, where the University of Central Florida plans to open a medical school by fall 2008, is a better site for an East Coast hub than Port St. Lucie's expansive Tradition development, which has been wooing Burnham since last year.

Six months after Port St. Lucie hosted a private catered dinner for Burnham's decision-makers at Tradition's town hall, Burnham officials were flying into Orlando Tuesday night on the Orlando Magic's corporate jet and were scheduled to dine at the Ritz-Carlton.

In Port St. Lucie, all the lavish attention has coaxed the green-eyed monster out of hiding.

"It's like somebody else is dating my girlfriend," Port St. Lucie Councilman Jack Kelly said of Orlando's treatment of Burnham. "I'm not going to deny there's jealousy there, but we put our best foot forward."

With details of both communities' financial offers under wraps — both are reportedly in the $80 million to $90 million range, not including land, with up to $245 million in incentives from the state — the big question is what will tip the scales for Burnham.

Among Port St. Lucie's biggest assets, officials believe, is its proximity to Scripps' Jupiter campus, about a 30-minute drive away. Another strong point is a possible collaboration with the University of Florida, widely viewed as the state's research powerhouse, if Burnham settles on Port St. Lucie.

The Port St. Lucie City Council endorsed new fees on construction Monday to raise an estimated $70 million to pay for the 175,000-square-foot building the city would build, then lease to Burnham.

Though Orlando entered the Burnham race months after Port St. Lucie, it isn't backing off. In fact, it can be seen as an opportunity three years in the making.

That's how long it has been since Orlando lost its bid for The Scripps Research Institute to Palm Beach County, and city officials have been working ever since to beef up their strategy for attracting players in the life sciences industry.

"When we got past our disappointment, we said, 'Hey, (Scripps) is here. Let's take advantage of it,' " said Maureen Brockman, a vice president at the Metro Orlando Economic Development Commission.

A big part of that strategy was landing a medical school for UCF, she said.

"We understand what a competitive realm life sciences is," Brockman said. "But with the medical school here, at least we're in the game."

Lake Nona's developer, Tavistock Group, headed by billionaire Joe Lewis, has donated $12.5 million and 50 acres to UCF to help expedite the medical school's plans.

With the medical school only a few years off, Lake Nona has accelerated plans for a 1.5 million-square-foot village center, including an open-air regional mall, within the community, said Robert Adams, marketing and public relations vice president for Lake Nona Property Holdings LLC, the community's development arm.

The medical school and the shopping and entertainment district are not far from the Lake Nona Science and Technology Research Park, a 500-acre undeveloped swath where Burnham could set up its campus. Nearby, some of Lake Nona's New Urbanist development has taken root in the NorthLake Park area of townhomes and an award-winning grade school.

Another feather in Orlando's cap: The well-connected Lewis was credited with helping bring the Scripps possibility to Florida. Plus, his Tavistock Group has a life sciences division based in La Jolla, Calif., the home of Burnham and Scripps.

Burnham officials have said they expect to make a decision this summer about where to open their next campus. Once established, the Burnham site stands to generate hundreds of jobs directly, and could spawn more indirectly by acting as a magnet for other companies.

"There are lots of things that have to be decided and fall into place," said Burnham spokeswoman Nancy Beddingfield, who declined to elaborate on the details of the decision.

Though the Orlando visit has the attention of Port St. Lucie officials, several say they are largely unfazed.

"They absolutely should be doing their due diligence and going and visiting all opportunities for the company," Port St. Lucie Councilwoman Michelle Berger said. "But am I worried? No. I'm not worried. I know that the Burnham Institute people are scientists, and scientist look at facts.

"And the fact is that Port St. Lucie is the best location for the Burnham Institute."

Wednesday, June 14, 2006

St. Lucie plans to turn garbage into electricity

By Jim Reeder

FORT PIERCE — An Atlanta company has been chosen to design, build and operate a plant using technology that's rarely been applied to disposing of household garbage.

Higher energy prices now make it economical to use St. Lucie County's solid waste to generate electricity, according to Hilburn O. Hillestad, president of Geoplasma LLC in Atlanta.

Plasma arc technology uses electrical discharges similar to lightning to create temperatures so high that solid waste practically vaporizes. Gas produced by the process can turn an electric generator while a solid material is useful in concrete and asphalt paving.

With even bigger piles of garbage in Atlanta, why come to St. Lucie County?

"St. Lucie County runs its own landfill and can enter into a contract," Hillestad said. "Other local governments have long-term contracts with private companies to operate their landfills."

Two plants in Japan are the only ones known to use plasma arcs to convert household garbage into electricity.

County Commissioner Chris Craft said Solid Waste Manager Leo Cordeiro and assistant Ron Roberts learned about the technology.

"They've been researching for four or five years and contacted Geoplasma," Craft said.

Several years ago Cordeiro and Roberts persuaded commissioners to build a plant to compress garbage into bales, reducing the volume that goes into the landfill.

That project has attracted visitors from China, South America and other areas.

Commissioners told their staff Tuesday to start contract negotiations with Geoplasma, a process that could take six months. A plant could be in operation two years later, officials said.

Geoplasma proposes to design, build and operate the plant using money paid by haulers to dump their loads at the landfill and revenue from selling electricity.

About 120 pounds of coke, a form of coal, will be used daily to help distribute the heat and act as a catalyst in the gasification process.

Florida Power & Light Co. wanted to bring millions of tons of coal to burn in a generating plant. That plan was rejected unanimously by commissioners.

FORT PIERCE — An Atlanta company has been chosen to design, build and operate a plant using technology that's rarely been applied to disposing of household garbage.

Higher energy prices now make it economical to use St. Lucie County's solid waste to generate electricity, according to Hilburn O. Hillestad, president of Geoplasma LLC in Atlanta.

Plasma arc technology uses electrical discharges similar to lightning to create temperatures so high that solid waste practically vaporizes. Gas produced by the process can turn an electric generator while a solid material is useful in concrete and asphalt paving.

With even bigger piles of garbage in Atlanta, why come to St. Lucie County?

"St. Lucie County runs its own landfill and can enter into a contract," Hillestad said. "Other local governments have long-term contracts with private companies to operate their landfills."

Two plants in Japan are the only ones known to use plasma arcs to convert household garbage into electricity.

County Commissioner Chris Craft said Solid Waste Manager Leo Cordeiro and assistant Ron Roberts learned about the technology.

"They've been researching for four or five years and contacted Geoplasma," Craft said.

Several years ago Cordeiro and Roberts persuaded commissioners to build a plant to compress garbage into bales, reducing the volume that goes into the landfill.

That project has attracted visitors from China, South America and other areas.

Commissioners told their staff Tuesday to start contract negotiations with Geoplasma, a process that could take six months. A plant could be in operation two years later, officials said.

Geoplasma proposes to design, build and operate the plant using money paid by haulers to dump their loads at the landfill and revenue from selling electricity.

About 120 pounds of coke, a form of coal, will be used daily to help distribute the heat and act as a catalyst in the gasification process.

Florida Power & Light Co. wanted to bring millions of tons of coal to burn in a generating plant. That plan was rejected unanimously by commissioners.

Tuesday, June 13, 2006

Parking fee for Martin beaches would face hurdles

By Jason Schultz

Palm Beach Post Staff Writer

STUART — When Martin County officials suggested Port St. Lucie builders help pay for their new residents' impacts across the county line, city officials responded with what seemed a simple alternative: Charge a parking fee for beach and boat ramp access.

But a Martin County report shows that may not be as simple as it looks.

Port St. Lucie officials had proposed that Martin County charge out-of-county residents the fee after Martin officials said the developers of several large western Port St. Lucie subdivisions should pay them impact fees.

"Just charge $1 and give county residents a sticker," Port St. Lucie Councilman Jack Kelly said. "It's simple."

But according to a report from Martin County Senior Planner Clyde Dulin, several of Martin County's beaches, such as Sea Turtle Beach, Bathtub Reef Park and Bob Graham Park, are partially owned by the state. The state would have to approve parking fees and how the money could be spent.

Several boat ramps, such as the ones at the foot of the Jensen Beach and Stuart causeway bridges, are owned by the state, Dulin said.

Plus, the county bought much of its beach land with state and federal grants from the Florida Communities Trust and the National Park Service. Dulin said the federal park service grants prohibit charging higher parking fees for nonresidents.

He said Florida Communities Trust officials told him that the state would allow revenue from parking fees on beaches to be used only for maintaining that beach, not for buying more land for parking lots.

"Yes, parking fees are possible, but they may not be as easy as you might think, and they may not accomplish what you are after, which is purchasing more property for parking," Dulin said. "It's unlikely we would be able to charge different fees between residents and nonresidents at these beaches."

Calls to Florida Communities Trust spokesmen were not returned Monday.

Martin County Commissioner Michael DiTerlizzi suggested that if the county cannot charge different rates to outside residents, officials could give county residents a beach parking permit when they pay their annual tax bill. The county then could figure out exactly how much each resident pays in taxes to maintain the beaches and charge out-of-county visitors the same amount for an annual pass when they come to the beach, he said.

Port St. Lucie officials said those hurdles still did not mean their developers should have to pay.

"If they don't own those beaches, why are they trying to make us pay for them?" Mayor Bob Minsky asked. "User fees are the fairest type of tax in the world. I don't ask them to fill up my gas tank for me."

Kelly said other communities have charged for parking, so he does not think it would be so hard for Martin County. Collier County gives its residents parking stickers and charges non-county residents $6 to park at several public beaches.

Meanwhile, Martin County officials are continuing to ask for impact fees from the large Port St. Lucie developments. County Administrator Duncan Ballantyne said he plans to meet with Port St. Lucie City Manager Don Cooper next week to discuss the issue.

Palm Beach Post Staff Writer

STUART — When Martin County officials suggested Port St. Lucie builders help pay for their new residents' impacts across the county line, city officials responded with what seemed a simple alternative: Charge a parking fee for beach and boat ramp access.

But a Martin County report shows that may not be as simple as it looks.

Port St. Lucie officials had proposed that Martin County charge out-of-county residents the fee after Martin officials said the developers of several large western Port St. Lucie subdivisions should pay them impact fees.

"Just charge $1 and give county residents a sticker," Port St. Lucie Councilman Jack Kelly said. "It's simple."

But according to a report from Martin County Senior Planner Clyde Dulin, several of Martin County's beaches, such as Sea Turtle Beach, Bathtub Reef Park and Bob Graham Park, are partially owned by the state. The state would have to approve parking fees and how the money could be spent.

Several boat ramps, such as the ones at the foot of the Jensen Beach and Stuart causeway bridges, are owned by the state, Dulin said.

Plus, the county bought much of its beach land with state and federal grants from the Florida Communities Trust and the National Park Service. Dulin said the federal park service grants prohibit charging higher parking fees for nonresidents.

He said Florida Communities Trust officials told him that the state would allow revenue from parking fees on beaches to be used only for maintaining that beach, not for buying more land for parking lots.

"Yes, parking fees are possible, but they may not be as easy as you might think, and they may not accomplish what you are after, which is purchasing more property for parking," Dulin said. "It's unlikely we would be able to charge different fees between residents and nonresidents at these beaches."

Calls to Florida Communities Trust spokesmen were not returned Monday.

Martin County Commissioner Michael DiTerlizzi suggested that if the county cannot charge different rates to outside residents, officials could give county residents a beach parking permit when they pay their annual tax bill. The county then could figure out exactly how much each resident pays in taxes to maintain the beaches and charge out-of-county visitors the same amount for an annual pass when they come to the beach, he said.

Port St. Lucie officials said those hurdles still did not mean their developers should have to pay.

"If they don't own those beaches, why are they trying to make us pay for them?" Mayor Bob Minsky asked. "User fees are the fairest type of tax in the world. I don't ask them to fill up my gas tank for me."

Kelly said other communities have charged for parking, so he does not think it would be so hard for Martin County. Collier County gives its residents parking stickers and charges non-county residents $6 to park at several public beaches.

Meanwhile, Martin County officials are continuing to ask for impact fees from the large Port St. Lucie developments. County Administrator Duncan Ballantyne said he plans to meet with Port St. Lucie City Manager Don Cooper next week to discuss the issue.

Higher impact fee gains support

By Teresa Lane

Palm Beach Post Staff Writer

PORT ST. LUCIE — The cost of building a new home or apartment in Port St. Lucie is about to rise $2,081 after city council members Monday unanimously endorsed the higher fee to lure the prestigious Burnham Institute and biomedical research to Port St. Lucie.

With little discussion, the council gave preliminary support to the landmark proposal, which raises existing impact fees of about $11,700 to $13,780 to provide money for a 175,000-square-foot research lab earmarked for Burnham, which also is considering Orlando for its Florida campus.

With impact fees of only $6,500 as recently as 18 months ago, one contractor said Monday that the added $2,081 in public building fees would hamper the city's construction industry and place affordable homes further from the reach of a typical wage earner.

"Property taxes have gone up, and there is a lot more money coming into the city," said Dagoberto Castillo of LuJoVa Homes, which builds about 35 homes each year in Port St. Lucie. "Most of it is coming out of the builders' pockets. Sales are going down, and interest rates are up."

The higher public-building impact fee on new homes and multifamily units could raise $70 million during the next 10 years for the city to build a lab that it could lease to Burnham. That's close to the $80 million Burnham reportedly wants from the city.

Legal and financial consultants who suggested the higher fee could be used for economic development said they're not aware of other cities or counties in Florida or nationwide that have implemented a similar fee for that purpose, but insisted it's justifiable to help move Port St. Lucie from a bedroom community to a research hub with higher-wage jobs and a higher standard of living.

If council members adopt the higher fee on final reading June 26, they will delay enforcement and collection until an agreement with Burnham is in place. Although officials seemed confident of their chances of luring the company a few months ago, a last-minute, no-holds-barred pitch from Orlando has them feeling less certain as the summer — and a decision — drag on.

Home builder Don Santos, a former president of the Treasure Coast Builders Association, said 80 percent of the organization's board members support higher impact fees to lure Burnham but would like builders of nonresidential buildings, such as offices and stores, to pay the higher fee, too.

Robert Chandler IV of Fishkind & Associates, an economic consulting firm that recommended the development fee, said nonresidential buildings were not included because they already are considered components of economic development.

Chandler said residents will benefit directly from such high-tech tenants as Burnham in Port St. Lucie because such a move "changes the landscape" and provides better jobs, shorter commutes and a higher quality of life.

"We have endorsed this impact fee, which is really unusual for us," Santos said of the builders organization. "We'd just like everyone to pay, because right now the residential home builders are hurting. Adding additional fees is a concern of ours, especially now."

Palm Beach Post Staff Writer

PORT ST. LUCIE — The cost of building a new home or apartment in Port St. Lucie is about to rise $2,081 after city council members Monday unanimously endorsed the higher fee to lure the prestigious Burnham Institute and biomedical research to Port St. Lucie.

With little discussion, the council gave preliminary support to the landmark proposal, which raises existing impact fees of about $11,700 to $13,780 to provide money for a 175,000-square-foot research lab earmarked for Burnham, which also is considering Orlando for its Florida campus.

With impact fees of only $6,500 as recently as 18 months ago, one contractor said Monday that the added $2,081 in public building fees would hamper the city's construction industry and place affordable homes further from the reach of a typical wage earner.

"Property taxes have gone up, and there is a lot more money coming into the city," said Dagoberto Castillo of LuJoVa Homes, which builds about 35 homes each year in Port St. Lucie. "Most of it is coming out of the builders' pockets. Sales are going down, and interest rates are up."

The higher public-building impact fee on new homes and multifamily units could raise $70 million during the next 10 years for the city to build a lab that it could lease to Burnham. That's close to the $80 million Burnham reportedly wants from the city.

Legal and financial consultants who suggested the higher fee could be used for economic development said they're not aware of other cities or counties in Florida or nationwide that have implemented a similar fee for that purpose, but insisted it's justifiable to help move Port St. Lucie from a bedroom community to a research hub with higher-wage jobs and a higher standard of living.

If council members adopt the higher fee on final reading June 26, they will delay enforcement and collection until an agreement with Burnham is in place. Although officials seemed confident of their chances of luring the company a few months ago, a last-minute, no-holds-barred pitch from Orlando has them feeling less certain as the summer — and a decision — drag on.

Home builder Don Santos, a former president of the Treasure Coast Builders Association, said 80 percent of the organization's board members support higher impact fees to lure Burnham but would like builders of nonresidential buildings, such as offices and stores, to pay the higher fee, too.

Robert Chandler IV of Fishkind & Associates, an economic consulting firm that recommended the development fee, said nonresidential buildings were not included because they already are considered components of economic development.

Chandler said residents will benefit directly from such high-tech tenants as Burnham in Port St. Lucie because such a move "changes the landscape" and provides better jobs, shorter commutes and a higher quality of life.

"We have endorsed this impact fee, which is really unusual for us," Santos said of the builders organization. "We'd just like everyone to pay, because right now the residential home builders are hurting. Adding additional fees is a concern of ours, especially now."

Stuart approves subdivision, supports hotel

By ANA X. CERON

A hotel is in sight for the south end of the city, and a new residential subdivision is in store for the north.

The Stuart City Commission backed both projects Monday night, supporting a proposal for a new four-story hotel on Fischer Street east of U.S. 1 and approving plans for Savanna Place north of the Roosevelt Bridge.

The 83-room hotel is subject to a final vote scheduled for June 26.

"We think if not here, where?" said attorney Terry McCarthy, representing Seacoast Hotels Inc., the partnership behind the proposal.

With Jeff Krauskopf absent, the commission agreed, unanimously endorsing the project.

"We have a shortage of hotels on the Treasure Coast," Commissioner Michael Mortell said.

Although the 2.75-acre parcel has been dubbed the "Hampton Inn" site — after the brand originally eyed for the property — Seacoast President Ram Patel said his group is still looking for an operator. Some of the choices include La Quinta or Country Inn.

"We have a few in mind," Patel said. "We haven't pinpointed" one.

Plans are more final for the city's other new development.

The commission gave its blessing to Savanna Place, a 60-home subdivision planned for eight pine-studded acres south of County Road 707, just east of Wright Boulevard.

The project calls for a mix of single-family homes, duplexes and town houses beside an upland preserve area traversed by a mulched walking trail.

Since Hai Group USA, the project developer, didn't seek any exceptions to the urban code, and its project followed the site's zoning, Monday's go-ahead was a basic approval of the site plan.

A hotel is in sight for the south end of the city, and a new residential subdivision is in store for the north.

The Stuart City Commission backed both projects Monday night, supporting a proposal for a new four-story hotel on Fischer Street east of U.S. 1 and approving plans for Savanna Place north of the Roosevelt Bridge.

The 83-room hotel is subject to a final vote scheduled for June 26.

"We think if not here, where?" said attorney Terry McCarthy, representing Seacoast Hotels Inc., the partnership behind the proposal.

With Jeff Krauskopf absent, the commission agreed, unanimously endorsing the project.

"We have a shortage of hotels on the Treasure Coast," Commissioner Michael Mortell said.

Although the 2.75-acre parcel has been dubbed the "Hampton Inn" site — after the brand originally eyed for the property — Seacoast President Ram Patel said his group is still looking for an operator. Some of the choices include La Quinta or Country Inn.

"We have a few in mind," Patel said. "We haven't pinpointed" one.

Plans are more final for the city's other new development.

The commission gave its blessing to Savanna Place, a 60-home subdivision planned for eight pine-studded acres south of County Road 707, just east of Wright Boulevard.

The project calls for a mix of single-family homes, duplexes and town houses beside an upland preserve area traversed by a mulched walking trail.

Since Hai Group USA, the project developer, didn't seek any exceptions to the urban code, and its project followed the site's zoning, Monday's go-ahead was a basic approval of the site plan.

Thursday, June 08, 2006

North Hutchinson Island homeowners sue over condo plan

A group of homeowners is seeking judicial review of the county commission's decision last month to rezone a commercially zoned piece of property on the island to become a mixed-use development with 80 condominiums.

The petition was filed by the North Beach Association of St. Lucie County and Michael Riordan, a homeowner near what will become the Grande Beach North Hutchinson Island development. The property, currently home to the Sands Plaza, will be transformed into condominiums and 10,000 square feet of commercial space.

In court papers, they argue the rezoning did not meet criteria under the county land development code, specifically a requirement that residential land uses may not exceed 40 percent of mixed-use developments. They claim 34 units should be the maximum instead of the 80 units that were granted.

They claim the rezoning will increase density in an area threatened by hurricanes and major storms and could make disaster evacuation and re-entry more difficult. The commission still must vote on a final site plan approval for the development.

Residents were on both sides of the issue during a county commission meeting in early May on the project.

The petition was filed by the North Beach Association of St. Lucie County and Michael Riordan, a homeowner near what will become the Grande Beach North Hutchinson Island development. The property, currently home to the Sands Plaza, will be transformed into condominiums and 10,000 square feet of commercial space.

In court papers, they argue the rezoning did not meet criteria under the county land development code, specifically a requirement that residential land uses may not exceed 40 percent of mixed-use developments. They claim 34 units should be the maximum instead of the 80 units that were granted.

They claim the rezoning will increase density in an area threatened by hurricanes and major storms and could make disaster evacuation and re-entry more difficult. The commission still must vote on a final site plan approval for the development.

Residents were on both sides of the issue during a county commission meeting in early May on the project.

Wednesday, June 07, 2006

New homes in PSL may soon cost $2,000 more

By CHRIS YOUNG

PORT ST. LUCIE — The city is considering imposing a $2,081 impact fee on new homes to raise $70 million for a biotech building that could house the Burnham Institute.

The economic development proposal was approved Tuesday by the city's Planning and Zoning Board and is scheduled to be discussed by City Council at Monday's meeting.

Under the proposal, the "job growth/economic development building" would be considered a public building like a police headquarters or parking garage, so would be eligible for impact fee money.

A fee schedule included with the proposal calls for an economic development impact fee of $2,081 per new single-family or multifamily housing unit. Combined with a $360 impact fee for government buildings, the total "public buildings" impact fee would reach $2,441 on a new single family home. The new fee would pay for a 175,000-square-foot biotech building, according a consultant's report.

City Attorney Roger Orr confirmed the proposal is designed to lure the Burnham Institute, the La Jolla, Calif.-based biotech research and development company that wants to move to Florida. Burnham is considering a site in the Tradition development.

"Considering our goal is to bring jobs to the community, to the new annexed areas, this (fee) is the way for new growth to pay for itself," Vice Mayor Patricia Christensen said.

Planning & Zoning board officials unanimously voted to send the proposal to City Council.

"It seems like the City Council has come up with a creative way (to fund) economic development," said board member Frank Lillo.

"I think it's the only fair way we can raise the money to do what we want to do," board member Earl Thoms said.

The consultant's report, by Fishkind & Associates, justified charging the impact fee by arguing new residents will benefit from the jobs created by economic development. Christensen said new residents who have nothing to do with Burnham or spinoff biotech companies still would benefit from their presence by increased taxes that the commercial properties will pay.

"The point of bringing Burnham here is so residents aren't paying the brunt of taxes," she said.

She said if Burnham doesn't take the city's offer, which would be matched by the state, the impact fees would not take effect.

But the Council could bring back the ordinance for another high-profile company at a later date, she said.

Proposed fee

• The Planning & Zoning board recommended a $2,081 impact fee on all new homes to lure the Burnham Institute to the city.

• The fees would buy a 175,000 square-foot biotech center at a cost of $70 million.

• City Council members will consider the impact fee at Monday's regular meeting.

PORT ST. LUCIE — The city is considering imposing a $2,081 impact fee on new homes to raise $70 million for a biotech building that could house the Burnham Institute.

The economic development proposal was approved Tuesday by the city's Planning and Zoning Board and is scheduled to be discussed by City Council at Monday's meeting.

Under the proposal, the "job growth/economic development building" would be considered a public building like a police headquarters or parking garage, so would be eligible for impact fee money.

A fee schedule included with the proposal calls for an economic development impact fee of $2,081 per new single-family or multifamily housing unit. Combined with a $360 impact fee for government buildings, the total "public buildings" impact fee would reach $2,441 on a new single family home. The new fee would pay for a 175,000-square-foot biotech building, according a consultant's report.

City Attorney Roger Orr confirmed the proposal is designed to lure the Burnham Institute, the La Jolla, Calif.-based biotech research and development company that wants to move to Florida. Burnham is considering a site in the Tradition development.

"Considering our goal is to bring jobs to the community, to the new annexed areas, this (fee) is the way for new growth to pay for itself," Vice Mayor Patricia Christensen said.

Planning & Zoning board officials unanimously voted to send the proposal to City Council.

"It seems like the City Council has come up with a creative way (to fund) economic development," said board member Frank Lillo.

"I think it's the only fair way we can raise the money to do what we want to do," board member Earl Thoms said.

The consultant's report, by Fishkind & Associates, justified charging the impact fee by arguing new residents will benefit from the jobs created by economic development. Christensen said new residents who have nothing to do with Burnham or spinoff biotech companies still would benefit from their presence by increased taxes that the commercial properties will pay.

"The point of bringing Burnham here is so residents aren't paying the brunt of taxes," she said.

She said if Burnham doesn't take the city's offer, which would be matched by the state, the impact fees would not take effect.

But the Council could bring back the ordinance for another high-profile company at a later date, she said.

Proposed fee

• The Planning & Zoning board recommended a $2,081 impact fee on all new homes to lure the Burnham Institute to the city.

• The fees would buy a 175,000 square-foot biotech center at a cost of $70 million.

• City Council members will consider the impact fee at Monday's regular meeting.

Tuesday, June 06, 2006

St. Lucie schools face big shake-up

By MARGOT SUSCA

Schools Superintendent Michael Lannon on Monday announced a major staff shake-up for the coming school year as the district faces new attendance zones, growth and increasing efforts to boost student achievement.

After an intensive staff review — which included analyzing FCAT scores — Lannon said at least 15 administrators will be in new jobs and six top-level positions have been filled in new schools. Another six administrative positions remain vacant.

Just as the district looks at testing data to determine whom to send where, Lannon said principals' personalities, education and strengths also were factored into the appointments.

"Ultimately it becomes a gut decision given everything we know about where is the best fit," Lannon said. "This is the best we can do for the individuals, for the schools and for the communities they're there to serve."

Lannon said he wanted the changes announced before the state Education Departments releases high-profile school grades that are based on FCAT scores. That announcement is expected this month.

Most of the shuffle is at the elementary or K-8 level.

No administrative changes are slated at high schools, where teenagers this year continued to show weak performance on standardized reading and math exams.

Lannon said Fort Pierce Westwood High Principal Lin Bushore is expected to retire at the end of the 2006-07 year. Fort Pierce Central High and Port St. Lucie High had major administrative overhauls at the start of the 2005-06 year.

"It takes more than a year to be able to make sustainable change," Lannon said. "Part of our job is to be able to analyze and coach and mentor and be part of that process to make sure change is happening."

Notable changes include the resignation of Oak Hammock K-8 Principal Daniel O'Keefe, who leaves after heading that school in its first year. O'Keefe, a longtime Broward County administrator who lives in Fellsmere, came out of retirement to take the top spot at Oak Hammock.

Oak Hammock, in Port St. Lucie, will have an entire new staff next year, including Principal Carmen Peterson who leaves Port St. Lucie Elementary.

Glenn Rustay, known for his quirky neckties and love of technology, will lead Port St. Lucie Elementary, an A-rated school slated for a major K-8 face-lift by August 2008. Rustay has been assistant principal there.

District officials project opening a new school a year for the next several years, including a K-8 on Jenkins Road that would open in August 2007. Lisa Cash leaves Southern Oaks to take the reins there.

John Lynch, former county testing head and principal at Garden City Elementary in Fort Pierce, will take over for Cash.

Cortina Gray leaves her assistant principal job at top- rated Frances K. Sweet Elementary School, a Fort Pierce magnet school, to lead Garden City.

Under the new attendance zones, Garden City's low- income student population is expected to jump. Gray says she can balance the high standards of F.K. Sweet with the issues Garden City children may bring to classrooms.

Key changes

Notable changes announced by Schools Superintendent Michael Lannon:

• Fort Pierce Westwood High Principal Lin Bushore is expected to retire at the end of the 2006-07 year.

• Oak Hammock K-8 to get an entire new slate of administrators.

• No changes at the high school level, but Fort Pierce Westwood and St. Lucie West Centennial will hire additional assistant principals.

Schools Superintendent Michael Lannon on Monday announced a major staff shake-up for the coming school year as the district faces new attendance zones, growth and increasing efforts to boost student achievement.

After an intensive staff review — which included analyzing FCAT scores — Lannon said at least 15 administrators will be in new jobs and six top-level positions have been filled in new schools. Another six administrative positions remain vacant.

Just as the district looks at testing data to determine whom to send where, Lannon said principals' personalities, education and strengths also were factored into the appointments.

"Ultimately it becomes a gut decision given everything we know about where is the best fit," Lannon said. "This is the best we can do for the individuals, for the schools and for the communities they're there to serve."

Lannon said he wanted the changes announced before the state Education Departments releases high-profile school grades that are based on FCAT scores. That announcement is expected this month.

Most of the shuffle is at the elementary or K-8 level.

No administrative changes are slated at high schools, where teenagers this year continued to show weak performance on standardized reading and math exams.

Lannon said Fort Pierce Westwood High Principal Lin Bushore is expected to retire at the end of the 2006-07 year. Fort Pierce Central High and Port St. Lucie High had major administrative overhauls at the start of the 2005-06 year.

"It takes more than a year to be able to make sustainable change," Lannon said. "Part of our job is to be able to analyze and coach and mentor and be part of that process to make sure change is happening."

Notable changes include the resignation of Oak Hammock K-8 Principal Daniel O'Keefe, who leaves after heading that school in its first year. O'Keefe, a longtime Broward County administrator who lives in Fellsmere, came out of retirement to take the top spot at Oak Hammock.

Oak Hammock, in Port St. Lucie, will have an entire new staff next year, including Principal Carmen Peterson who leaves Port St. Lucie Elementary.

Glenn Rustay, known for his quirky neckties and love of technology, will lead Port St. Lucie Elementary, an A-rated school slated for a major K-8 face-lift by August 2008. Rustay has been assistant principal there.

District officials project opening a new school a year for the next several years, including a K-8 on Jenkins Road that would open in August 2007. Lisa Cash leaves Southern Oaks to take the reins there.

John Lynch, former county testing head and principal at Garden City Elementary in Fort Pierce, will take over for Cash.

Cortina Gray leaves her assistant principal job at top- rated Frances K. Sweet Elementary School, a Fort Pierce magnet school, to lead Garden City.

Under the new attendance zones, Garden City's low- income student population is expected to jump. Gray says she can balance the high standards of F.K. Sweet with the issues Garden City children may bring to classrooms.

Key changes

Notable changes announced by Schools Superintendent Michael Lannon:

• Fort Pierce Westwood High Principal Lin Bushore is expected to retire at the end of the 2006-07 year.

• Oak Hammock K-8 to get an entire new slate of administrators.

• No changes at the high school level, but Fort Pierce Westwood and St. Lucie West Centennial will hire additional assistant principals.

Thursday, June 01, 2006

St. Lucie property tax roll will go up

By REBECCA PANOFF

FORT PIERCE – Even with the real estate market cooling off, St. Lucie County, Fort Pierce and Port St. Lucie will see at least a 16 percent increases in their tax rolls according to numbers released by Property Appraiser Jeff Furst.

According to the preliminary tax roll released by Furst to county and city officials to help them gauge their budgets, every municipality in the county saw an increase, although St. Lucie Village's increase was only estimated at 6 percent.

But Furst said Thursday his preliminary numbers are conservative and he thinks the final tax roll, released July 1, could be as high or higher than last year's numbers.

FORT PIERCE – Even with the real estate market cooling off, St. Lucie County, Fort Pierce and Port St. Lucie will see at least a 16 percent increases in their tax rolls according to numbers released by Property Appraiser Jeff Furst.

According to the preliminary tax roll released by Furst to county and city officials to help them gauge their budgets, every municipality in the county saw an increase, although St. Lucie Village's increase was only estimated at 6 percent.

But Furst said Thursday his preliminary numbers are conservative and he thinks the final tax roll, released July 1, could be as high or higher than last year's numbers.

Wednesday, May 31, 2006

St. Lucie County Civic Center being torn down

By Jim Reeder

FORT PIERCE — The St. Lucie County Civic Center has gone from opera house to warehouse in its 29 years.

It's been the scene of performances by Ray Charles, the Royal Lipizzaner Stallions, the Charlie Daniels Band and high school graduates marching down the aisle.

Now, a new phase is starting for the county-owned building. Its bricks will soon provide a habitat for fish.

A huge hole was knocked out of the civic center's northeast corner Tuesday, the official start of demolition for the building whose prime of life ended when Hurricane Frances damaged its roof. The demolition is expected to take about three months.

The civic center was providing shelter for special needs patients in 2004 when Frances peeled off its roof, allowing water to pour in on people with medical problems.

After that it was used to store tarps, meals-ready-to-eat and water that would be needed when the next storm struck.

But on Tuesday people were only talking about the good times had there, despite the bad acoustics and uncomfortable seats.

"When it was good, it was real good," county recreation manager Patti Raffensberger said. "A lot of people came through here and had good times. "We're going to miss it," she said. Havert Fenn, who served on the county commission 16 years, remembers performances by Ray Charles and B.B. King, as well as boxing matches.

"I must be getting old, seeing history like this," Fenn said. "I remember when it was built and now I'm seeing it come down."

The Treasure Coast Opera Society staged operas there for years before the building was damaged.

"It was great for horse shows, but not so good for music," Jack Connolly, an opera supporter and member of the county's Cultural Arts Council, said. "If you love opera, you have to make allowances, you have to go with what you've got."

He remembers the night the opera audience wrapped itself in blankets because of chilly weather in an unheated building. The Opera Society has moved its performances to the Sunrise Theater in downtown Fort Pierce.

County Commissioner Chris Craft remembers attending concerts by Johnny Paycheck, Mel Tillis and the Oak Ridge Boys.

"When you're six or seven years old you don't care about the acoustics," Craft said. "As bad as the acoustics and the roof leaks were, we all have good memories of the civic center.

County Administrator Doug Anderson said the site will be used temporarily for a parking lot while the county studies what to do with the space. One possibility is to build a new commission chambers.

The county's hurricane shelter for people with special needs will remain this hurricane season at Dan McCarty Middle School in Fort Pierce, as it was last year. But the special needs shelter eventually will be moved to a gymnasium that will be built in the Lawnwood Recreation Complex, across 23rd Street from the civic center site.

FORT PIERCE — The St. Lucie County Civic Center has gone from opera house to warehouse in its 29 years.

It's been the scene of performances by Ray Charles, the Royal Lipizzaner Stallions, the Charlie Daniels Band and high school graduates marching down the aisle.

Now, a new phase is starting for the county-owned building. Its bricks will soon provide a habitat for fish.

A huge hole was knocked out of the civic center's northeast corner Tuesday, the official start of demolition for the building whose prime of life ended when Hurricane Frances damaged its roof. The demolition is expected to take about three months.

The civic center was providing shelter for special needs patients in 2004 when Frances peeled off its roof, allowing water to pour in on people with medical problems.

After that it was used to store tarps, meals-ready-to-eat and water that would be needed when the next storm struck.

But on Tuesday people were only talking about the good times had there, despite the bad acoustics and uncomfortable seats.

"When it was good, it was real good," county recreation manager Patti Raffensberger said. "A lot of people came through here and had good times. "We're going to miss it," she said. Havert Fenn, who served on the county commission 16 years, remembers performances by Ray Charles and B.B. King, as well as boxing matches.

"I must be getting old, seeing history like this," Fenn said. "I remember when it was built and now I'm seeing it come down."

The Treasure Coast Opera Society staged operas there for years before the building was damaged.

"It was great for horse shows, but not so good for music," Jack Connolly, an opera supporter and member of the county's Cultural Arts Council, said. "If you love opera, you have to make allowances, you have to go with what you've got."

He remembers the night the opera audience wrapped itself in blankets because of chilly weather in an unheated building. The Opera Society has moved its performances to the Sunrise Theater in downtown Fort Pierce.

County Commissioner Chris Craft remembers attending concerts by Johnny Paycheck, Mel Tillis and the Oak Ridge Boys.

"When you're six or seven years old you don't care about the acoustics," Craft said. "As bad as the acoustics and the roof leaks were, we all have good memories of the civic center.

County Administrator Doug Anderson said the site will be used temporarily for a parking lot while the county studies what to do with the space. One possibility is to build a new commission chambers.

The county's hurricane shelter for people with special needs will remain this hurricane season at Dan McCarty Middle School in Fort Pierce, as it was last year. But the special needs shelter eventually will be moved to a gymnasium that will be built in the Lawnwood Recreation Complex, across 23rd Street from the civic center site.

Friday, May 26, 2006

High-tech firm revealed, confirms moving headquarters to PSL

By ROBERT BARBA

St. Lucie County has lured Carling Technologies, a global leader in circuit breakers and electric switches, a move that will bring higher-paying jobs and more high-tech visibility to the Treasure Coast.

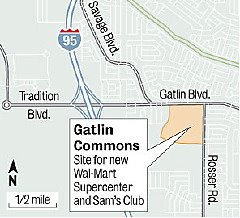

The Connecticut-based company will move its corporate headquarters and research and development arm to the north end of Tradition in Port St. Lucie in July 2008.

"It's official," Ed Rosenthal, executive vice president and corporate counsel of Carling, said from the company's headquarters in Plainville. "We have to stay flexible and we think we can do that down there."

Carling's recruitment is part of a local effort to shift the economy from one reliant on agriculture and call centers to one rich in research and development.

Although they may have little in common, Carling could be a neighbor to Burnham Institute if the California-based biotechnology research institute opens a satellite campus in Tradition.

Local and state officials are recruiting Burnham to the state and an announcement could come in the next few months.

Carling will employ 150 people earning an average hourly wage of $26.60, according to the county's incentive package. That translates to about $55,000 annually.

COULD DRAW OTHERS

The company's relocation will entice other companies to the area, said Port St. Lucie city council members.

"We have a clean slate out west (along the I-95 corridor), and we have more to offer people than quarter-acre lots and strip malls," said councilman Christopher Cooper.

"You could have 10-story buildings out there. The goal is to have a corporate presence along I-95."

Port St. Lucie City Council is planning a special meeting today to consider a five-year tax-savings package for Carling. The city's incentives could be worth $350,000 to $450,000 in total, said city manager Don Cooper said. Those figures are based on estimates of building costs of about $15 million.

The exact amount will depend on the final cost of the building, he said.

Government and business development and leaders had kept the company's identity secret, calling it "Project I" in public documents. Negotiations with a Northeast-based tech firm were first disclosed in September by Tradition executives when the city approved The Landing's site plan.

Earlier this week, county commissioners approved a $1 million incentive for the company. The package includes a $255,000 Job Growth Investment grant that will pay $1,700 per job created and property tax exemption valued at $850,000 that will be spread out over nine years.

A COLLABORATIVE EFFORT

The relocation was a collaboration among city and county officials, Core Communities, the Economic Development Council of St. Lucie County and Chris Klein, president and broker of Treasure Coast Commercial Real Estate Inc.

Klein's firm is brokering the 5.5-acre parcel where Carling plans to build. The new home will sit just north of The Landing, Tradition's big-box retail center. That deal is expected to close in late June.

"This is one of the most exciting deals that I have ever worked on," Klein said.

Other members of the recruitment team declined to comment on Thursday's announcement.

Core Communities' president Pete Hegener has often spoken of creating a 5-mile job corridor along I-95.

Rosenthal said Carling is coming to Port St. Lucie because of the "changing climate of manufacturing" and the different types of technology that the company is developing.

In addition to the incentive package, the company was also impressed with the officials' enthusiasm, the Kight Center for Emerging Technologies at Indian River Community College and Florida Atlantic University.

LEAVING A VOID

Rosenthal said it was too early to tell how many people from Connecticut would move to Port St. Lucie. The company is excited to work with some members of the "new work force," he said.

Carling's exit from Plainville will hurt that city's economy. The company is the eighth largest employer, said Robert Lee, town manager. He was surprised at the departure, but because of the economics of the region the announcement wasn't unexpected.

"Given the economy and amount of companies moving from the north to the south, for various economic reasons, it's not surprising," Lee said.

"What's surprising is that it's happening in Plainville. It's hitting a little closer to home."

Carling chief operating officer Mike Bhojwani broke the news to the 160 Connecticut employees at 3 p.m. Thursday, Rosenthal said. Some tooling and press-related work will remain in Plainville.

The move will not affect Carling's wide-flung operations. About 2,600 employees are spread among offices in England, France, Germany, Hong Kong and Japan. In November, the company opened a 250,000-square-foot manufacturing plant in ZhongShan, China, Rosenthal said.

St. Lucie County has lured Carling Technologies, a global leader in circuit breakers and electric switches, a move that will bring higher-paying jobs and more high-tech visibility to the Treasure Coast.

The Connecticut-based company will move its corporate headquarters and research and development arm to the north end of Tradition in Port St. Lucie in July 2008.

"It's official," Ed Rosenthal, executive vice president and corporate counsel of Carling, said from the company's headquarters in Plainville. "We have to stay flexible and we think we can do that down there."

Carling's recruitment is part of a local effort to shift the economy from one reliant on agriculture and call centers to one rich in research and development.

Although they may have little in common, Carling could be a neighbor to Burnham Institute if the California-based biotechnology research institute opens a satellite campus in Tradition.

Local and state officials are recruiting Burnham to the state and an announcement could come in the next few months.

Carling will employ 150 people earning an average hourly wage of $26.60, according to the county's incentive package. That translates to about $55,000 annually.

COULD DRAW OTHERS

The company's relocation will entice other companies to the area, said Port St. Lucie city council members.

"We have a clean slate out west (along the I-95 corridor), and we have more to offer people than quarter-acre lots and strip malls," said councilman Christopher Cooper.

"You could have 10-story buildings out there. The goal is to have a corporate presence along I-95."

Port St. Lucie City Council is planning a special meeting today to consider a five-year tax-savings package for Carling. The city's incentives could be worth $350,000 to $450,000 in total, said city manager Don Cooper said. Those figures are based on estimates of building costs of about $15 million.

The exact amount will depend on the final cost of the building, he said.

Government and business development and leaders had kept the company's identity secret, calling it "Project I" in public documents. Negotiations with a Northeast-based tech firm were first disclosed in September by Tradition executives when the city approved The Landing's site plan.

Earlier this week, county commissioners approved a $1 million incentive for the company. The package includes a $255,000 Job Growth Investment grant that will pay $1,700 per job created and property tax exemption valued at $850,000 that will be spread out over nine years.

A COLLABORATIVE EFFORT

The relocation was a collaboration among city and county officials, Core Communities, the Economic Development Council of St. Lucie County and Chris Klein, president and broker of Treasure Coast Commercial Real Estate Inc.

Klein's firm is brokering the 5.5-acre parcel where Carling plans to build. The new home will sit just north of The Landing, Tradition's big-box retail center. That deal is expected to close in late June.

"This is one of the most exciting deals that I have ever worked on," Klein said.

Other members of the recruitment team declined to comment on Thursday's announcement.

Core Communities' president Pete Hegener has often spoken of creating a 5-mile job corridor along I-95.

Rosenthal said Carling is coming to Port St. Lucie because of the "changing climate of manufacturing" and the different types of technology that the company is developing.

In addition to the incentive package, the company was also impressed with the officials' enthusiasm, the Kight Center for Emerging Technologies at Indian River Community College and Florida Atlantic University.

LEAVING A VOID

Rosenthal said it was too early to tell how many people from Connecticut would move to Port St. Lucie. The company is excited to work with some members of the "new work force," he said.

Carling's exit from Plainville will hurt that city's economy. The company is the eighth largest employer, said Robert Lee, town manager. He was surprised at the departure, but because of the economics of the region the announcement wasn't unexpected.

"Given the economy and amount of companies moving from the north to the south, for various economic reasons, it's not surprising," Lee said.

"What's surprising is that it's happening in Plainville. It's hitting a little closer to home."

Carling chief operating officer Mike Bhojwani broke the news to the 160 Connecticut employees at 3 p.m. Thursday, Rosenthal said. Some tooling and press-related work will remain in Plainville.

The move will not affect Carling's wide-flung operations. About 2,600 employees are spread among offices in England, France, Germany, Hong Kong and Japan. In November, the company opened a 250,000-square-foot manufacturing plant in ZhongShan, China, Rosenthal said.

Wednesday, May 24, 2006

St. Lucie County luring at least 150 jobs

By REBECCA PANOFF and ROBERT BARBA

FORT PIERCE — St. Lucie County officials have approved an incentive package worth about $1 million that will be used to lure an undisclosed company to the county.

County commissioners at their meeting Tuesday morning approved a letter of intent that would provide the company with $255,000 in Job Growth Investment funds payable over five years, beginning in 2008.

The grant is contingent on the company providing a minimum of 150 jobs with an average hourly wage of $26.60 an hour.

County Administrator Doug Anderson said county officials have worked for more than a year on the project, which could bring in high-paying corporate-type jobs.

"It's another high-paying clean industry that would be relocated to St. Lucie County," Anderson said.

As part of the agreement, the company would also receive a full county property tax abatement for its first five years and then a reduced abatement for the next four years, totaling about $850,000. That amount is based on the company's estimated initial investment of $14.5 million. As part of the incentive package, the company must stay in St. Lucie County for at least 15 years or all exempt taxes plus interest must be paid back.

Before Port St. Lucie's bid for La Jolla, Calif.-based Burnham Institute was made public in January, the possible corporate relocation of a Northeast-based high-tech firm was at the center of economic development efforts in the area.

Don Root, executive director of the Economic Development Council of St. Lucie County, declined to confirm if the company, called "Project I", was the high-tech firm.

FORT PIERCE — St. Lucie County officials have approved an incentive package worth about $1 million that will be used to lure an undisclosed company to the county.

County commissioners at their meeting Tuesday morning approved a letter of intent that would provide the company with $255,000 in Job Growth Investment funds payable over five years, beginning in 2008.

The grant is contingent on the company providing a minimum of 150 jobs with an average hourly wage of $26.60 an hour.

County Administrator Doug Anderson said county officials have worked for more than a year on the project, which could bring in high-paying corporate-type jobs.

"It's another high-paying clean industry that would be relocated to St. Lucie County," Anderson said.

As part of the agreement, the company would also receive a full county property tax abatement for its first five years and then a reduced abatement for the next four years, totaling about $850,000. That amount is based on the company's estimated initial investment of $14.5 million. As part of the incentive package, the company must stay in St. Lucie County for at least 15 years or all exempt taxes plus interest must be paid back.

Before Port St. Lucie's bid for La Jolla, Calif.-based Burnham Institute was made public in January, the possible corporate relocation of a Northeast-based high-tech firm was at the center of economic development efforts in the area.

Don Root, executive director of the Economic Development Council of St. Lucie County, declined to confirm if the company, called "Project I", was the high-tech firm.

Thursday, May 18, 2006

Fort Pierce, St. Lucie County ranked eighth best golf hometown

By KEVIN VAN BRIMMER

Fort Pierce and St. Lucie County have been ranked as the No. 8 best golf hometown in Florida by Golf Digest for the publication's Real Estate Special Report in the upcoming June issue.

In determining the rankings, Golf Digest rated 244 counties nationwide and detailed the 10 best communities in eight regions. The rankings took into account both golf and non-golf factors, including the number and quality of course, golf days per year, course congestion and crime rates, airport access, off-course amenities and cost of living.

While Fort Pierce is identified in the listing, Golf Digest's Andrew Katcher said the ranking included all of St. Lucie County. In Florida, St. Lucie County ranked by the North of Tampa area, West Palm Beach, Punta Gorda (Charlotte County), the Greater Orlando area, Sarasota and Tampa/St. Pete. Jacksonville came in at No. 9 and Daytona Beach at No. 10.

Fort Pierce and St. Lucie County have been ranked as the No. 8 best golf hometown in Florida by Golf Digest for the publication's Real Estate Special Report in the upcoming June issue.

In determining the rankings, Golf Digest rated 244 counties nationwide and detailed the 10 best communities in eight regions. The rankings took into account both golf and non-golf factors, including the number and quality of course, golf days per year, course congestion and crime rates, airport access, off-course amenities and cost of living.

While Fort Pierce is identified in the listing, Golf Digest's Andrew Katcher said the ranking included all of St. Lucie County. In Florida, St. Lucie County ranked by the North of Tampa area, West Palm Beach, Punta Gorda (Charlotte County), the Greater Orlando area, Sarasota and Tampa/St. Pete. Jacksonville came in at No. 9 and Daytona Beach at No. 10.

Monday, May 08, 2006

Treasure Coast becomes home to a half-million residents

By JIM TURNER

More than a half million people now call the Treasure Coast home, according to the latest U.S. Census numbers.

Barring further cement shortages, hurricanes or a sudden desire by people to live in colder, less sunny climates, the 600,000 mark could be surpassed by the next national census in 2010, with the three-quarter million mark reached in nine to 19 years, depending upon whose growth projections are used.

Most of the new residents are white, elderly or part of the aging Baby Boomer generation that is moving into retirement. But the face of those who are newly minted Treasure Coast residents has also been taking on a Latin tint as urban flight spills northward from South Florida.

Greg Vaday, economic development coordinator with the Treasure Coast Regional Planning Council, said a single long-range future growth projection would be misleading.

However, he estimated the region could double or triple before reaching what could be considered "build out," when there would be more people than could be manageable for a quality lifestyle.

More than a half million people now call the Treasure Coast home, according to the latest U.S. Census numbers.

Barring further cement shortages, hurricanes or a sudden desire by people to live in colder, less sunny climates, the 600,000 mark could be surpassed by the next national census in 2010, with the three-quarter million mark reached in nine to 19 years, depending upon whose growth projections are used.

Most of the new residents are white, elderly or part of the aging Baby Boomer generation that is moving into retirement. But the face of those who are newly minted Treasure Coast residents has also been taking on a Latin tint as urban flight spills northward from South Florida.

Greg Vaday, economic development coordinator with the Treasure Coast Regional Planning Council, said a single long-range future growth projection would be misleading.

However, he estimated the region could double or triple before reaching what could be considered "build out," when there would be more people than could be manageable for a quality lifestyle.

Friday, May 05, 2006

PSL giving free lots to low-income residents

By CHRIS YOUNG May 5, 2006

PORT ST. LUCIE — The city wants to give away seven residential lots to very low-income residents to build their dream homes.

The problem is, there aren't enough applicants.

One woman now lives in a home under the city program. The city gave her a lot and $23,000 for a down payment, and Habitat For Humanity built the house, said Community Services Director Tricia Swift-Pollard, who heads the program.

The city will give another lot away soon. But six other lots haven't been awarded yet. Swift-Pollard said she thinks not many people have heard about the program.

Applicants do need one or two years of good credit and be able to qualify for at least a $50,000 mortgage. They cannot make over 50 percent of median income, which changes based on family size. For a family of four, that limit is $27,300; for two people, $21,850.

The city gives the lot and up to $75,000 for a down payment and closing costs as an interest-free second mortgage on the home.

The mortgage must be paid when the homeowner sells the house or refinances but doesn't require payments before that.

"(The city) is being very accommodating to the needs of homeowners," said Runa Saunders, vice president of retail banking at Harbor Federal Savings Bank in Fort Pierce, noting the inclusion of a lot to build on.

Swift-Pollard said there were only five houses for sale in the entire city priced under $150,000 as of mid-April, and 330 homes in the $175,000 to $200,000 range.

While some people at the income level targeted by the city's program might not qualify because of bad credit, it is entirely possible to qualify, loan officers said.

Saunders said that having good credit means managing finances wisely and paying bills on time, such as rent, utilities or car insurance.

"(But) if you don't pay rent on time, we can't loan the money for a house, knowing your history," she cautioned.

PORT ST. LUCIE — The city wants to give away seven residential lots to very low-income residents to build their dream homes.

The problem is, there aren't enough applicants.

One woman now lives in a home under the city program. The city gave her a lot and $23,000 for a down payment, and Habitat For Humanity built the house, said Community Services Director Tricia Swift-Pollard, who heads the program.

The city will give another lot away soon. But six other lots haven't been awarded yet. Swift-Pollard said she thinks not many people have heard about the program.

Applicants do need one or two years of good credit and be able to qualify for at least a $50,000 mortgage. They cannot make over 50 percent of median income, which changes based on family size. For a family of four, that limit is $27,300; for two people, $21,850.

The city gives the lot and up to $75,000 for a down payment and closing costs as an interest-free second mortgage on the home.

The mortgage must be paid when the homeowner sells the house or refinances but doesn't require payments before that.

"(The city) is being very accommodating to the needs of homeowners," said Runa Saunders, vice president of retail banking at Harbor Federal Savings Bank in Fort Pierce, noting the inclusion of a lot to build on.

Swift-Pollard said there were only five houses for sale in the entire city priced under $150,000 as of mid-April, and 330 homes in the $175,000 to $200,000 range.

While some people at the income level targeted by the city's program might not qualify because of bad credit, it is entirely possible to qualify, loan officers said.

Saunders said that having good credit means managing finances wisely and paying bills on time, such as rent, utilities or car insurance.

"(But) if you don't pay rent on time, we can't loan the money for a house, knowing your history," she cautioned.

Thursday, May 04, 2006

Developers should stop building 'commodity' homes

By NADIA GERGIS

Construction throughout the Treasure Coast soared in the first quarter, pushing inventory levels to a record high, according to an industry report released Tuesday.

The number of starts adds more inventory to an already saturated market for existing single-family homes, said American MetroStudy, a Boca Raton-based provider of information on real estate and housing.

Brad Hunter, a housing economist for American MetroStudy, said it could take six months in one county and more than a year in two counties, to sell all the new homes.

"Historically, these are very high figures. They're actually the highest amount of finished inventory I have ever seen," Hunter said. "I think builders should be concerned."

Levels were high in St. Lucie County, with 747 homes started during the first quarter, compared to the 528 during the first quarter of 2005. There were 844 finished vacant homes in the county on March 31.

At the current rate of closings, there's a six-month supply of new homes in the St. Lucie market, the report said.

"This is not the time to build commodity homes unless they (developers) can build them better and/or less expensively than anyone else," Hunter said.

"Speculators have an overabundance of commodity homes, all at competitive prices. To be successful, builders must sell something that is different from currently available supply."

Housing starts in Martin County rose to 161 in the first quarter from 143 in the same period last year, a 13 percent increase. There were 897 homes under construction or finished and vacant in Martin County, about a 14-month supply.

Indian River had the smallest quarterly growth in home starts on the Treasure Coast. Inventory levels rose to 569 units, up slightly from 546 in the first quarter of 2005, a 4.2 percent increase.

The number of finished, vacant homes rose to 598 units during the first quarter, which drove the inventories to a 13-month supply.

Housing experts said the numbers don't bode well for builders on the Treasure Coast.

"This is the reason we're seeing builders offer so much in incentives," said Richard Hope, president of Treasure Coast Builders Association and president of The Hope Co. in Vero Beach. "Buyers are seeing a widening of choices, so builders are really having to stand out with their products."

Builders also are competing with investors who want to flip properties they bought at lower prices last year, said Jack McCabe, president of McCabe Research and Consulting, a real estate consulting firm in Deerfield Beach. A stagnating re-sale market isn't helping builders, he said.

"Builders who continue to put up spec homes without a signed contract, well, that's just foolery on their part," McCabe said. "There has been a dramatic shift in the market since the speculators left the market."

McCabe said that with sellers no longer able to push up prices, the rental market is changing. He said the growing trend of South Florida re-conversions — apartments converted to condos and put back on the rental market by their investor-owners — has entered the Treasure Coast.

"The Estates at Stuart has entered the re-conversion market because people realize that they can make some money with the rental rates being so great," McCabe said, referring to the Estates at Stuart, a 237-unit apartment complex that sold for a record $45 million last year.

"The Treasure Coast is just saturated with for-sale and for-rent signs. What does that tell us about the reality of market conditions?"

The report listed three Treasure Coast communities that had the most new home starts in South Florida. The subdivisions of Martin's Crossing in Martin and Newport Isles by Centex Homes in St. Lucie, and Core Communities' Tradition in St. Lucie County were part of the top 10 South Florida communities with the most home construction starts.

Shawn Reilly, vice president of marketing for Core Communities, developer of the master-planned communities of St. Lucie West and Tradition said he wasn't surprised at the rankings.

"I think people realize that we offer good value and people love our way of life here," Reilly said.

As for St. Lucie County having the highest inventory levels on the Treasure Coast, Reilly said he wasn't concerned.

"This isn't affecting us. It's happening to scattered lots in Port St. Lucie," Reilly said. "We see this as a good thing because we really tried to prevent flippers from buying here. Now that they're gone, we can focus on our real buyers."

St. Lucie's Savannas State Park ranked in top 10

Savannas State Preserve Park ranked in the top 10 for educational and historical facilities throughout the nation in a ranking by a national camping organization, state officials announced Wednesday.

ReserveAmerica, the organization used to reserve campsites throughout the nation, honored the Florida Parks Service in its annual awards for America's Top Outdoor Locations.

Of the 34 Florida spots, Savannas State Preserve Park — off Walton Road — was one of the best for education, due in large part to its volunteer teams and Environmental Education Center.

ReserveAmerica, the organization used to reserve campsites throughout the nation, honored the Florida Parks Service in its annual awards for America's Top Outdoor Locations.

Of the 34 Florida spots, Savannas State Preserve Park — off Walton Road — was one of the best for education, due in large part to its volunteer teams and Environmental Education Center.

Monday, May 01, 2006

Florida's Housing Market Indicators

Florida existing home sales: -22%

Florida existing condo sales: -23%

Florida existing home median price: $248,200

Florida existing condo median price: $214,200

Florida consumer confidence: 89

30-year fixed rate mortgage: 6.58%

National existing home sales: +.3%

National existing home median price $218,000

Pending home sales index 117.7

National consumer confidence: 109.6

National new home sales: +13.8 %

National new home median price $224,200

Florida existing condo sales: -23%

Florida existing home median price: $248,200

Florida existing condo median price: $214,200

Florida consumer confidence: 89

30-year fixed rate mortgage: 6.58%

National existing home sales: +.3%

National existing home median price $218,000

Pending home sales index 117.7

National consumer confidence: 109.6

National new home sales: +13.8 %

National new home median price $224,200

Indecision keeps Port St. Lucie's Riverwalk plans open

By HILLARY COPSEY

Hooters flew the coop long ago. Still, the 15,000-square-foot Promenade building sits on the canal at Rivergate Park — beautiful, but empty.

Culpepper & Terpening is just weeks away from completing the Promenade — Riverwalk's only finished development and one that's been under construction for three years. But the developer still has not found a replacement for the "delightfully tacky, yet unrefined" restaurant originally slated to anchor the building.

Hooters dropped out in 2004, citing a disagreement about the two-story building's height. Last year, Bernie Kosar announced plans for a swanky steakhouse on the site overlooking the North Fork of the St. Lucie River. That also fell through.

"It's just not the time for that," said Butch Terpening, Kosar's partner and Promenade developer. "We had other things on our plate."

As hurricanes and other problems slowed construction on the Promenade, Terpening said he decided to concentrate on finishing the building before finding tenants.

"We haven't really tried to market the property," Terpening said. "Give me a month or two."

But some City Council members say Terpening's empty building and the lack of developer interest in the rest of Riverwalk are signs of problems with the decades-long proposal for an entertainment district on the river.

"I think the vision has been over-inflated," Councilwoman Michelle Berger said. "It isn't Riverwalk. It's River-Down-the-Way-a-Bit. ... We can't make the Riverwalk because we can't walk next to the river."

The sections of Riverwalk that have moved forward in recent months — roughly 45 acres south of Port St. Lucie Boulevard slated to become a hotel and retail center and a botanical garden — are actually next to the North Fork. The Promenade overlooks a boat-launching canal off the river.

The rest of Riverwalk, a meandering 16.5 acres of developable land along Midport Road, is screened from the North Fork by acres of protected mangroves. Even developers who have shown interest in the property say the project is a difficult one requiring complex negotiations for environmental permits.

With no developer for Riverwalk North and council members still debating the right use for the property, Councilman Jack Kelly said it is understandable potential tenants would balk at signing on for the Promenade.

"With the indecision, they don't know what's going in up the street from them," Kelly said.

Still, Kelly and Councilman Christopher Cooper are searching for tenants for the Promenade in hopes the project's success will kickstart the rest of Riverwalk.